Negotiating with Your Insurance Company

Understanding Your Car Insurance Policy and Coverage Options

Okay, let's dive into the nitty-gritty. Before you even *think* about negotiating, you gotta know what you're working with. Pull out your car insurance policy – yeah, the one you probably haven't looked at since you signed up. Seriously, do it. We'll wait.

Got it? Good. Now, what are your coverage options? Liability? Collision? Comprehensive? Uninsured/Underinsured Motorist? What are your deductibles? Knowing these details is crucial. You can't effectively negotiate if you don't understand what you're paying for (or not paying for!). Think of it like trying to haggle for a car without knowing the engine size or the mileage. You'd be laughed out of the dealership.

Take some time to review each section. Liability covers damage you cause to others. Collision covers damage to your car, regardless of fault (but usually with a deductible). Comprehensive covers things like theft, vandalism, hail, and other acts of nature. Uninsured/Underinsured Motorist protects you if you're hit by someone who doesn't have insurance or doesn't have enough to cover your damages.

Knowing these things will allow you to identify areas where you might be over or under-insured. Maybe you're paying for collision coverage on a car that's barely worth anything. Maybe you're skimping on liability coverage, which could be a *huge* mistake if you cause an accident. Knowledge is power, my friend! And in this case, knowledge is money you can save.

Researching Average Car Insurance Rates and Identifying Potential Savings

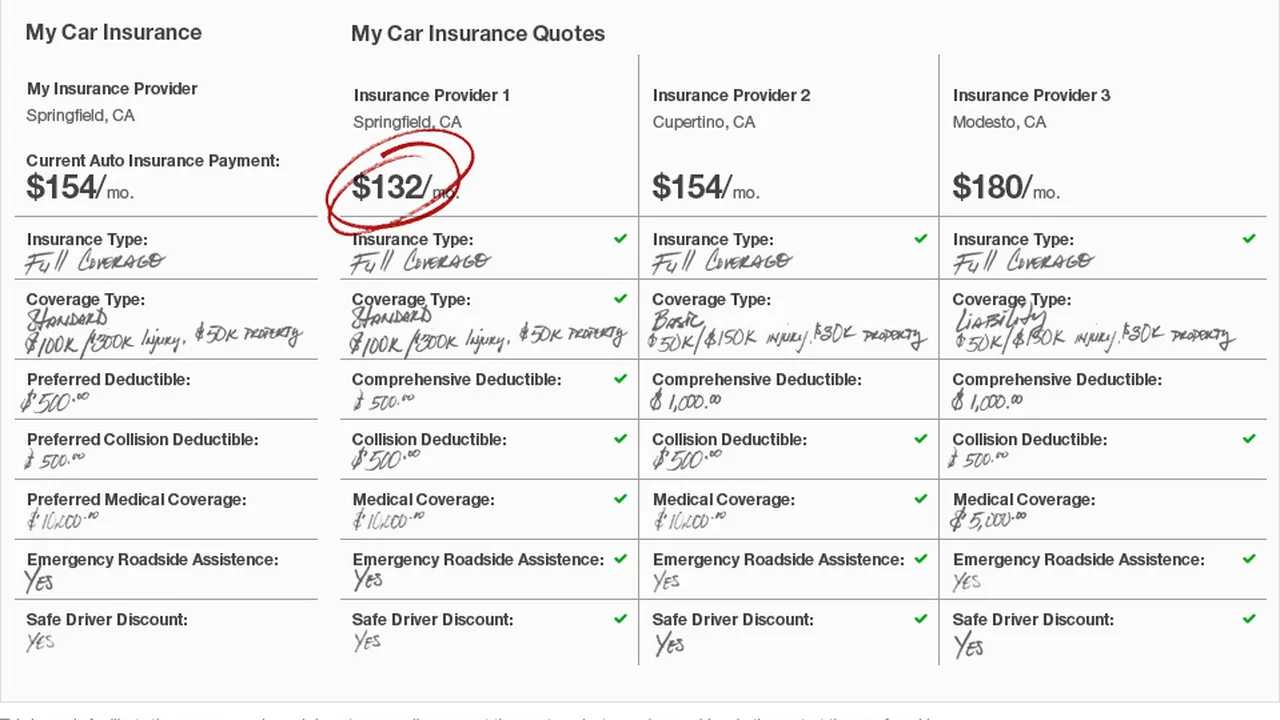

Alright, you know your policy. Now it's time to play detective. Head online and start researching average car insurance rates in your area. There are tons of websites that allow you to compare quotes from different companies. Use them! Enter your information – age, driving record, car make and model – and see what kind of rates you're getting.

Pay close attention to the differences in coverage levels and deductibles. A lower deductible will mean a higher premium, and vice versa. Experiment with different combinations to see how they affect your rate. This will give you a good benchmark for what you *should* be paying.

Don't just stick to the big-name insurance companies. Check out smaller, regional insurers as well. They often have competitive rates and may offer more personalized service. Also, consider getting quotes through independent insurance agents. They can shop around for you and find the best deals.

While you're researching, look for potential discounts you might be eligible for. Many companies offer discounts for things like good driving records, being a student, having multiple policies with them (bundling), and even for having certain safety features on your car. Every little bit helps!

Building a Strong Case for Negotiation with Your Insurance Company

Okay, you've done your homework. You know your policy, you know the average rates, and you've identified potential discounts. Now it's time to build your case. Think of it like preparing for a job interview. You need to be prepared to answer questions and justify your request.

Gather all your information – your policy details, your research on average rates, and any documentation that supports your claim for discounts. For example, if you recently completed a defensive driving course, have your certificate ready. If you installed a new anti-theft device on your car, have the receipt handy.

Write down a list of reasons why you think you deserve a lower rate. Maybe you've been a loyal customer for years. Maybe you have a clean driving record. Maybe you recently moved to a safer neighborhood. Whatever the reason, write it down and be prepared to articulate it clearly.

Practice your "pitch." Imagine you're talking to an insurance agent. Be polite, respectful, and professional. Explain your situation and why you believe you deserve a better rate. Be specific and provide evidence to support your claims. Don't just say "I think my rate is too high." Say "I've been a customer for five years, I have a clean driving record, and I've found comparable coverage for $200 less with another company."

Effective Negotiation Strategies for Lowering Your Car Insurance Premium

Alright, it's showtime! You've got your information, you've built your case, and you're ready to negotiate. Here are some effective strategies to help you get the best possible rate:

- Be polite and respectful: This seems obvious, but it's worth repeating. No one wants to help someone who's being rude or demanding. Treat the insurance agent with respect, even if you're frustrated.

- Be prepared to walk away: This is a powerful negotiating tactic. If the insurance company isn't willing to meet your needs, be prepared to switch to another company. Knowing that you have other options gives you leverage.

- Ask for discounts: Don't be afraid to ask about discounts you might be eligible for. Even if you don't see them listed on the website, it's worth asking. Sometimes, insurance companies have hidden discounts that they don't advertise.

- Increase your deductible: If you're willing to pay a higher deductible in the event of an accident, you can often lower your premium. Just make sure you can afford to pay the deductible if you need to.

- Bundle your policies: If you have other insurance policies, such as home insurance or renters insurance, consider bundling them with your car insurance. This can often result in significant savings.

- Shop around: This is the most important strategy of all. Don't just settle for the first quote you get. Shop around and compare rates from multiple companies. You might be surprised at how much you can save.

- Be persistent: Don't give up after the first try. If you're not happy with the initial offer, try negotiating again. Sometimes, it takes a few attempts to get the best possible rate.

Specific Product Recommendations and Comparisons for Saving Money on Car Insurance

Now, let's talk about some specific products and services that can help you save money on car insurance. These aren't necessarily "products" in the traditional sense, but rather strategies and tools you can use to lower your rates.

Usage-Based Insurance (UBI) Programs

These programs, offered by companies like Progressive (Snapshot), State Farm (Drive Safe & Save), and Allstate (Drivewise), track your driving habits using a mobile app or a small device plugged into your car. They monitor things like speed, braking, and mileage. If you're a safe driver, you can earn significant discounts on your insurance premiums.

Pros: Potential for significant savings, encourages safe driving habits, personalized rates based on your actual driving behavior.

Cons: Privacy concerns (your driving data is being tracked), potential for increased rates if you're not a safe driver, may not be available in all states.

Usage Scenarios: Ideal for safe drivers who don't drive excessively. Especially beneficial for young drivers who are often charged higher rates.

Comparison: Progressive Snapshot offers an immediate discount just for signing up, while State Farm Drive Safe & Save focuses more on long-term savings based on your driving habits. Allstate Drivewise offers rewards points that can be redeemed for merchandise and gift cards.

Pricing: The "price" is the potential impact on your premium. Good driving habits can lead to savings of up to 30%, while poor driving habits could increase your rate (though some programs guarantee that your rate won't increase).

Telematics Devices

Similar to UBI programs, telematics devices track your driving behavior. However, they often offer more advanced features, such as real-time feedback on your driving and alerts for potential safety hazards. Some insurance companies offer discounts for using telematics devices.

Pros: Improved safety, real-time feedback on driving habits, potential for discounts on insurance premiums.

Cons: Cost of the device, privacy concerns, potential for increased rates if you're not a safe driver.

Usage Scenarios: Ideal for drivers who want to improve their driving skills and save money on insurance.

Comparison: Many aftermarket telematics devices are available, offering a range of features and price points. Some insurance companies provide their own devices as part of their UBI programs.

Pricing: The cost of telematics devices can range from $50 to $200 or more.

Dash Cams

Dash cams record video footage of your driving. This can be invaluable in the event of an accident, as it provides evidence to support your claim. Some insurance companies offer discounts for using dash cams.

Pros: Provides evidence in case of an accident, deters reckless driving, potential for discounts on insurance premiums.

Cons: Cost of the dash cam, privacy concerns (depending on the model and features), can be distracting if not properly installed.

Usage Scenarios: Ideal for drivers who want to protect themselves in the event of an accident.

Comparison: Dash cams vary in terms of features, such as video quality, field of view, and recording capabilities. Some models also include GPS tracking and parking mode.

Pricing: Dash cams can range in price from $30 to $300 or more.

Defensive Driving Courses

Completing a defensive driving course can not only improve your driving skills but also qualify you for a discount on your car insurance. Many insurance companies offer discounts for drivers who complete these courses.

Pros: Improved driving skills, potential for discounts on insurance premiums, can help you avoid accidents.

Cons: Cost of the course, time commitment.

Usage Scenarios: Ideal for drivers who want to improve their driving skills and save money on insurance.

Comparison: Defensive driving courses are offered by various organizations, both online and in-person. The content and format of the courses may vary.

Pricing: The cost of defensive driving courses can range from $25 to $100 or more.

Reviewing and Adjusting Your Car Insurance Policy Regularly

Don't just set it and forget it! Car insurance isn't a one-time deal. Life changes, and your insurance needs to change with it. Review your policy at least once a year, or whenever you experience a major life event, such as:

- Moving to a new address

- Buying a new car

- Getting married or divorced

- Adding or removing a driver from your policy

- Experiencing a change in your driving record (e.g., getting a ticket or being involved in an accident)

Each of these events can affect your insurance rates. For example, moving to a safer neighborhood could lower your rate, while getting a speeding ticket could increase it. By reviewing your policy regularly, you can ensure that you're getting the best possible coverage at the lowest possible price.

Leveraging Loyalty and Bundling for Additional Car Insurance Savings

Loyalty can pay off! Some insurance companies offer discounts to long-term customers. If you've been with the same company for several years, it's worth asking if you're eligible for a loyalty discount.

Bundling, as mentioned earlier, is another great way to save money. If you have multiple insurance policies, such as car insurance, home insurance, and life insurance, consider bundling them with the same company. This can often result in significant savings.

Don't Be Afraid to Switch Car Insurance Companies for Better Rates

The most important thing to remember is that you're not obligated to stay with the same insurance company forever. If you're not happy with your current rate, don't be afraid to shop around and switch to a different company. There are tons of insurance companies out there, and they're all competing for your business. By comparing rates and coverage options, you can find the best deal for your needs.

So there you have it – a comprehensive guide to negotiating with your car insurance company and saving money on your premiums. Remember to do your research, build your case, and be prepared to negotiate. With a little effort, you can significantly lower your car insurance costs and keep more money in your pocket!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)