How to Choose the Right Car Insurance Coverage

Understanding Different Types of Car Insurance Coverage Options and Their Importance

So, you're looking to get car insurance, huh? Good on ya! It's one of those things you *really* don't want to skip out on. But figuring out what kind of coverage you need can feel like trying to decipher ancient hieroglyphics. Liability? Collision? Comprehensive? It's a lot! Let's break it down into plain English (well, plain-ish English) and get you sorted.

First things first, car insurance isn't just about protecting your car. It's about protecting your wallet, your assets, and potentially your future. A serious accident without proper insurance can leave you financially devastated. So, let's dive into the different types of coverage and why they matter.

Liability Coverage: Protecting You From Others' Claims and Lawsuits

Liability coverage is the foundation of most car insurance policies. It protects you if you're at fault in an accident that causes injury or property damage to someone else. Think of it as your financial shield in case you mess up. There are two main types of liability coverage:

- Bodily Injury Liability: This covers the medical expenses, lost wages, and pain and suffering of anyone injured in an accident you caused. It can also cover legal fees if you're sued.

- Property Damage Liability: This covers the cost of repairing or replacing someone else's car or property that you damaged in an accident. Think fences, mailboxes, or even buildings.

How much liability coverage do you need? This is a big question, and the answer depends on your financial situation and risk tolerance. Minimum coverage levels are often set by state law, but those are rarely enough. Imagine causing a serious accident with multiple injuries – the minimum coverage might not even scratch the surface of the potential costs. Consider getting enough liability coverage to protect your assets, like your house, savings, and investments. A good rule of thumb is to have at least $100,000 per person and $300,000 per accident for bodily injury liability, and $50,000 to $100,000 for property damage liability. If you have significant assets, you might even want to consider an umbrella policy, which provides additional liability coverage beyond your car insurance limits.

Collision Coverage: Repairing Your Car After an Accident

Collision coverage pays for damage to your car if you hit another vehicle or object, regardless of who's at fault. So, whether you rear-end someone, sideswipe a pole, or get hit by another driver, collision coverage will help cover the repair costs. It typically has a deductible, which is the amount you pay out of pocket before the insurance company kicks in.

Do you need collision coverage? If you have a newer car or a car that's worth a significant amount of money, collision coverage is generally a good idea. Even if you're a super careful driver, accidents happen. The cost of repairing or replacing a car can be substantial, and collision coverage can save you a lot of money in the long run. However, if you have an older car that's not worth much, or if you can easily afford to repair or replace your car yourself, you might consider skipping collision coverage to save on premiums. Think about the deductible too. A higher deductible means lower premiums, but it also means you'll pay more out of pocket if you have an accident. Choose a deductible that you're comfortable with.

Comprehensive Coverage: Protecting Your Car From Other Perils

Comprehensive coverage protects your car from damage caused by events other than collisions. This includes things like theft, vandalism, fire, hail, flood, and even hitting an animal. It's like a catch-all for everything else that can happen to your car.

Do you need comprehensive coverage? Like collision coverage, comprehensive coverage is generally a good idea if you have a newer car or a car that's worth a significant amount of money. It's also a good idea if you live in an area where theft, vandalism, or natural disasters are common. Imagine a hailstorm damaging your car – comprehensive coverage would cover the repairs. Or, if your car is stolen, comprehensive coverage would pay for its replacement (minus your deductible, of course). As with collision coverage, consider the deductible and choose an amount you're comfortable with.

Uninsured/Underinsured Motorist Coverage: Protecting Yourself From Uninsured Drivers

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you if you're hit by a driver who doesn't have insurance or doesn't have enough insurance to cover your damages. Unfortunately, there are a lot of uninsured drivers out there, and even drivers with insurance might not have enough coverage to pay for all of your medical bills and car repairs. UM/UIM coverage steps in to fill the gap.

Do you need UM/UIM coverage? Absolutely! This is one of the most important types of coverage to have, especially if you live in a state with a high percentage of uninsured drivers. Imagine being seriously injured in an accident caused by an uninsured driver – without UM/UIM coverage, you could be stuck paying for all of your medical bills out of pocket. UM/UIM coverage can also cover lost wages and pain and suffering. Get as much UM/UIM coverage as you can afford.

Personal Injury Protection (PIP): Covering Your Medical Expenses

Personal Injury Protection (PIP) coverage, also known as "no-fault" insurance, covers your medical expenses and lost wages after an accident, regardless of who's at fault. It's available in some states and can be a valuable addition to your policy.

Do you need PIP coverage? If you live in a state that offers PIP coverage, it's generally a good idea to get it. It can help you pay for your medical bills quickly, without having to wait for the other driver's insurance company to process your claim. It can also cover lost wages, which can be a lifesaver if you're unable to work after an accident.

Factors Affecting Car Insurance Premiums and How to Save Money

Okay, so now you know about the different types of coverage. But how much is all of this going to cost? Car insurance premiums are based on a variety of factors, including:

- Your Age and Gender: Younger drivers and male drivers tend to pay higher premiums because they're statistically more likely to be involved in accidents.

- Your Driving Record: If you have a history of accidents or traffic violations, you'll pay higher premiums.

- Your Credit Score: In many states, insurance companies use your credit score to help determine your premiums. A lower credit score can result in higher premiums.

- The Type of Car You Drive: Expensive cars and cars that are more likely to be stolen will cost more to insure.

- Where You Live: If you live in an area with a high rate of accidents or theft, you'll pay higher premiums.

- Your Coverage Levels: The more coverage you have, the higher your premiums will be.

How can you save money on car insurance? Here are a few tips:

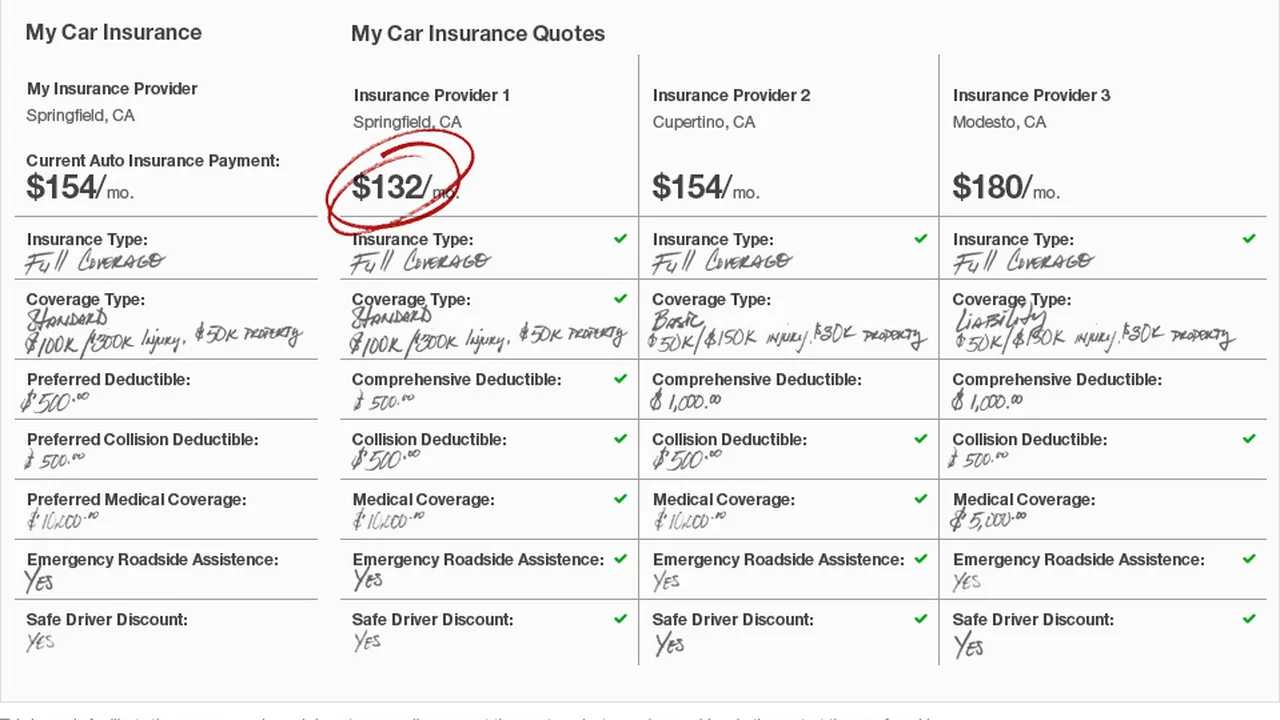

- Shop Around: Get quotes from multiple insurance companies to compare rates.

- Increase Your Deductibles: A higher deductible will lower your premiums.

- Maintain a Good Driving Record: Avoid accidents and traffic violations.

- Improve Your Credit Score: Pay your bills on time and keep your credit utilization low.

- Ask About Discounts: Many insurance companies offer discounts for things like being a safe driver, having multiple policies, or being a member of certain organizations.

- Consider Usage-Based Insurance: Some insurance companies offer policies that track your driving habits and adjust your premiums accordingly.

Recommended Car Insurance Products and Their Specific Use Cases

Alright, let's talk about some specific insurance products and when they might be a good fit for you. Keep in mind that this is just a general overview, and you should always talk to an insurance agent to get personalized advice.

Progressive Snapshot: Usage-Based Insurance for Safe Drivers

Product: Progressive Snapshot

Use Case: If you're a safe driver who doesn't drive many miles, Progressive Snapshot could save you a significant amount of money. It's a usage-based insurance program that tracks your driving habits, such as hard braking, speeding, and the time of day you drive. If you consistently demonstrate safe driving habits, you'll get a discount on your premiums.

Pros:

- Potential for significant savings for safe drivers.

- Provides feedback on your driving habits.

Cons:

- If you're not a safe driver, your premiums could increase.

- Requires you to install a device in your car that tracks your driving.

Pricing: The discount you receive depends on your driving habits. Progressive claims that safe drivers can save an average of $130 per year.

Geico DriveEasy: Another Option for Savings Through Safe Driving Monitoring

Product: Geico DriveEasy

Use Case: Similar to Progressive Snapshot, Geico DriveEasy monitors your driving habits through a smartphone app. It tracks things like hard braking, speeding, distracted driving (phone use), and time of day. If you consistently drive safely, you can earn discounts on your insurance premiums.

Pros:

- Potential for discounts based on safe driving habits.

- Convenient smartphone app for tracking.

- No need for additional hardware installation.

Cons:

- Privacy concerns about data collection.

- Discounts might not be significant for all drivers.

Pricing: Savings vary depending on your driving habits and location. Geico states that drivers can potentially save up to 25% on their premiums.

State Farm Drive Safe & Save: A Customizable Approach to Insurance Savings

Product: State Farm Drive Safe & Save

Use Case: State Farm's Drive Safe & Save offers personalized savings based on your driving behavior. Like the other programs, it uses a mobile app to track your driving habits. However, State Farm offers more customization options, allowing you to potentially earn even greater discounts if you consistently demonstrate safe driving.

Pros:

- Potential for significant savings based on driving habits.

- Customizable app for tracking.

Cons:

- Requires downloading and using the app.

- Privacy considerations for data collection.

Pricing: Savings vary, but State Farm claims you can save up to 50% by using the Drive Safe & Save app.

Erie Rate Lock: Price Protection for Long-Term Stability

Product: Erie Rate Lock

Use Case: If you value price stability and predictability, Erie's Rate Lock feature could be attractive. It essentially freezes your insurance rate, preventing it from increasing for certain reasons, such as minor accidents or claims. This can provide peace of mind, especially if you're a relatively safe driver but concerned about potential rate hikes.

Pros:

- Protection against rate increases due to minor incidents.

- Predictable insurance costs.

Cons:

- May not be available in all states.

- Rates can still increase due to other factors, such as moving or changing vehicles.

Pricing: Erie's rates are generally competitive, and the Rate Lock feature is often included at no extra cost.

Comparing Car Insurance Products: A Head-to-Head Analysis

Let's compare these products side-by-side to help you decide which one might be the best fit for you.

| Product | Focus | Data Collection Method | Potential Savings | Best For |

|---|---|---|---|---|

| Progressive Snapshot | Safe driving habits | Device installed in car | Average $130/year | Safe drivers who don't mind installing a device |

| Geico DriveEasy | Safe driving habits | Smartphone app | Up to 25% | Tech-savvy drivers who prefer a smartphone app |

| State Farm Drive Safe & Save | Safe driving habits | Smartphone app | Up to 50% | Drivers who want customizable savings options |

| Erie Rate Lock | Price stability | N/A (rate protection) | Protects against rate increases | Drivers who value predictable insurance costs |

Understanding Car Insurance Costs and Affordability

The cost of car insurance can vary significantly depending on the factors we discussed earlier. It's essential to get quotes from multiple insurance companies to compare rates and find the best coverage at the most affordable price. Don't just focus on the cheapest policy – make sure you're getting adequate coverage to protect your assets.

Here are some general price ranges for different types of car insurance coverage:

- Liability Coverage: $500 - $1,500 per year (depending on coverage limits)

- Collision Coverage: $300 - $700 per year (depending on deductible)

- Comprehensive Coverage: $150 - $500 per year (depending on deductible)

- Uninsured/Underinsured Motorist Coverage: $100 - $300 per year (depending on coverage limits)

- Personal Injury Protection (PIP): $200 - $500 per year (depending on coverage limits)

These are just estimates, and your actual costs may vary. The best way to find out how much car insurance will cost you is to get quotes from multiple insurance companies.

Final Thoughts on Choosing the Right Car Insurance

Choosing the right car insurance coverage can feel overwhelming, but it's an important decision that can protect you financially in the event of an accident. Take the time to understand the different types of coverage, consider your individual needs and circumstances, and shop around for the best rates. Don't be afraid to ask questions and seek advice from an insurance professional. Drive safe!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)