Comparing Car Insurance Quotes: Finding the Best Rates

Understanding Car Insurance Quotes and Why They Matter Saving Money on Car Insurance

Okay, so you're looking to save some cash on car insurance, right? Smart move! But before you dive headfirst into the murky waters of premiums and deductibles, let's talk about car insurance quotes. Think of them as your personal compass, guiding you towards the best deal possible. They're basically estimates of how much you'll pay for coverage, and comparing them is absolutely crucial. Why? Because prices can vary wildly between insurance companies – we’re talking potentially hundreds, even thousands, of dollars a year!

Ignoring quotes is like throwing money down the drain. You might be sticking with the first company you ever used, thinking it's the best, but trust me, loyalty doesn't always pay off in the insurance world. Companies are constantly tweaking their rates, running promotions, and targeting different demographics. So, what was a great deal five years ago might be overpriced now. Getting multiple quotes allows you to see the full landscape and make an informed decision.

Where to Find Car Insurance Quotes Online Resources and Local Agents Comparing Car Insurance Quotes

Alright, so you're convinced you need quotes. Great! Now, where do you find them? You've got a couple of main options: online comparison websites and local insurance agents. Each has its pros and cons.

Online comparison sites are super convenient. You can enter your information once, and they'll spit out quotes from a bunch of different companies. Think of them as one-stop shops for car insurance rates. Some popular ones include:

- The Zebra: This site is great for getting a quick overview of different companies and their rates. They also offer helpful tools like coverage calculators.

- QuoteWizard: Similar to The Zebra, QuoteWizard provides multiple quotes from various insurers.

- NerdWallet: NerdWallet isn't just for car insurance; they offer financial advice on a wide range of topics. But their car insurance comparison tool is solid and easy to use.

- Progressive's Online Tool: Progressive allows you to compare their rates alongside other major carriers on their own website. This offers a side-by-side comparison without navigating away.

The downside of these sites is that they don't always include every single insurance company. Some smaller, regional insurers might be missing. Also, the quotes you get are often just estimates, and the actual price might change after you talk to an agent.

Local insurance agents, on the other hand, can offer a more personalized experience. They can answer your questions, explain the different coverage options, and help you find discounts you might not have known about. They can also represent companies that aren't available on the online comparison sites. However, dealing with multiple agents can be time-consuming, and you might not get as many quotes as you would online.

The best approach? A combination of both! Start with online comparison sites to get a general idea of the market, then contact a few local agents to get more specific quotes and personalized advice.

Factors That Affect Car Insurance Quotes Age Driving History and Vehicle Type Car Insurance Rates

So, you're filling out those quote forms, and you're probably wondering, "What information do they need, and why?" Well, insurance companies use a whole bunch of factors to calculate your risk and determine your premium. Here are some of the most important ones:

- Age: Younger drivers are statistically more likely to get into accidents, so they usually pay higher rates. As you get older and gain more experience, your rates typically decrease.

- Driving History: This is a big one. If you have a clean driving record with no accidents or tickets, you'll get the best rates. But if you have a history of violations, expect to pay more. Even minor speeding tickets can impact your premium.

- Vehicle Type: The make and model of your car matters. Expensive cars, sports cars, and cars that are frequently stolen tend to have higher insurance rates. Safer cars with good safety ratings often qualify for discounts.

- Location: Where you live can significantly affect your rates. If you live in a densely populated city with high crime rates, you'll likely pay more than someone who lives in a rural area.

- Coverage Level: The amount of coverage you choose also impacts your premium. If you opt for the minimum required coverage, you'll pay less upfront, but you'll have less protection in case of an accident.

- Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible means a lower premium, but you'll have to pay more if you file a claim.

- Credit Score: In many states, insurance companies can use your credit score to determine your rates. A good credit score can help you get a lower premium.

Be honest when filling out the quote forms! Providing inaccurate information can lead to your policy being canceled or your claims being denied.

Understanding Different Types of Car Insurance Coverage Liability Collision and Comprehensive Insurance

Car insurance isn't just one big blob of protection. It's actually made up of different types of coverage, each designed to protect you from specific risks. Here's a breakdown of the most common types:

- Liability Coverage: This is the most basic type of coverage, and it's required in most states. It protects you if you're at fault in an accident and cause damage or injury to someone else. It covers their medical bills, car repairs, and other expenses. There are two types of liability coverage: bodily injury liability and property damage liability.

- Collision Coverage: This covers damage to your car if you're involved in an accident, regardless of who's at fault. It will pay to repair or replace your car, even if you caused the accident.

- Comprehensive Coverage: This covers damage to your car from things other than collisions, such as theft, vandalism, fire, hail, or floods.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're hit by a driver who doesn't have insurance or doesn't have enough insurance to cover your expenses.

- Personal Injury Protection (PIP): This covers your medical expenses and lost wages if you're injured in an accident, regardless of who's at fault. It's required in some states.

Choosing the right coverage can be tricky. Think about your financial situation, your risk tolerance, and the value of your car. If you have an older car that's not worth much, you might not need collision or comprehensive coverage. But if you have a newer car or a car that you rely on, you'll probably want to have both. Talk to an insurance agent to get personalized advice.

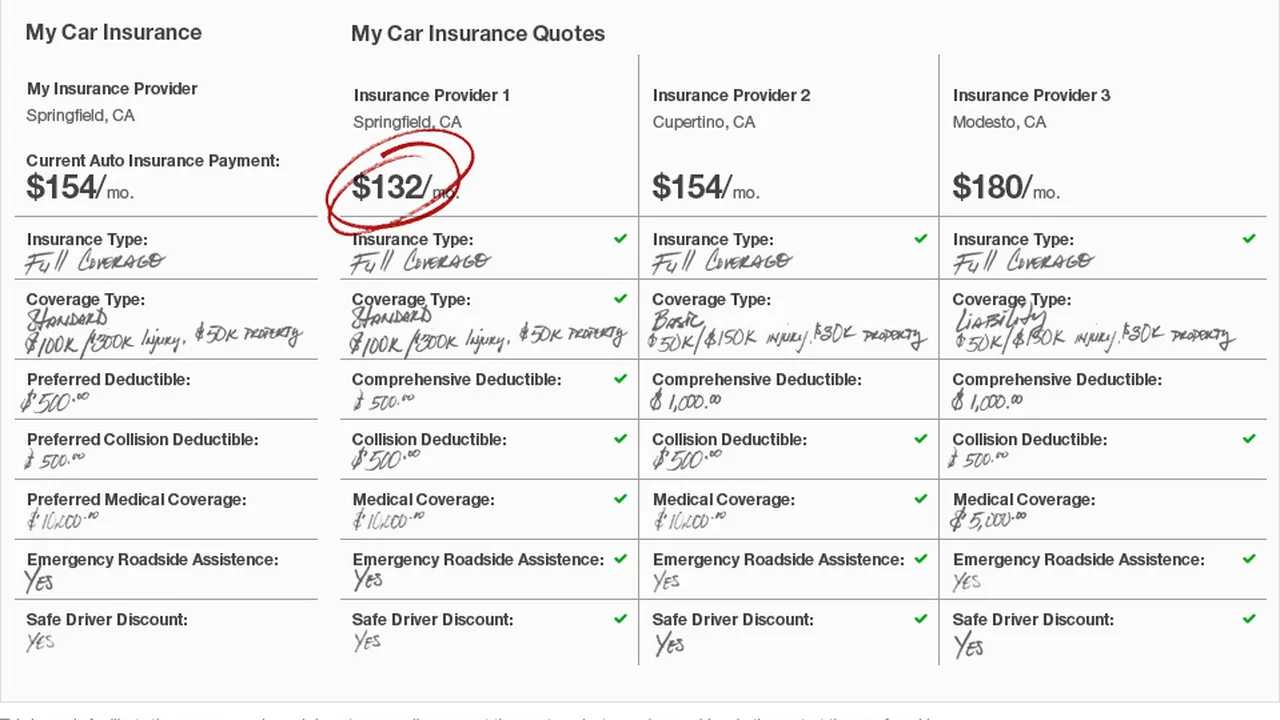

Specific Car Insurance Products and Scenarios Product Comparisons and Pricing

Let's get down to some specific examples of car insurance products and how they might fit into different scenarios. Remember, prices can vary significantly based on the factors we discussed earlier, so these are just ballpark figures.

Scenario 1: Young Driver with a New Car

Let's say you're a 20-year-old driver with a brand-new Honda Civic. You live in a suburban area and have a clean driving record (so far!). Here's a potential coverage setup and some approximate costs:

- Liability: $100,000/$300,000/$100,000 (Bodily Injury/Bodily Injury/Property Damage)

- Collision: $500 Deductible

- Comprehensive: $500 Deductible

- Uninsured/Underinsured Motorist: $50,000/$100,000

Potential Products and Pricing (Monthly):

- Progressive: $250 - $350 (Known for competitive rates for young drivers)

- State Farm: $300 - $400 (Solid coverage and customer service, but often pricier)

- Geico: $275 - $375 (Another good option for young drivers, with discounts available)

In this scenario, Progressive or Geico might be good starting points due to their potential for lower rates for younger drivers. However, State Farm offers strong customer service and a wide network of agents, which might be valuable if you prefer a more personal touch.

Scenario 2: Experienced Driver with an Older Car

Now, let's say you're a 45-year-old driver with a 10-year-old Toyota Camry. You have a spotless driving record and live in a rural area. You might be able to save money by reducing your coverage.

- Liability: $50,000/$100,000/$50,000

- Collision: (Optional - consider dropping if the car's value is low)

- Comprehensive: (Optional - consider dropping if the car's value is low)

- Uninsured/Underinsured Motorist: $25,000/$50,000

Potential Products and Pricing (Monthly):

- Liberty Mutual: $75 - $150 (Offers discounts for safe drivers and homeowners)

- Allstate: $80 - $160 (Similar to Liberty Mutual, with a wide range of discounts)

- Smaller Regional Insurer (e.g., Erie Insurance): $60 - $140 (Often offer competitive rates in specific geographic areas)

Since your car is older and you have a good driving record, you might be able to get away with lower liability limits and dropping collision and comprehensive coverage. Liberty Mutual and Allstate are good options for experienced drivers with safe records. Exploring smaller regional insurers can also yield significant savings.

Product Comparisons: A Deeper Dive

Let's compare some specific features of different insurance companies:

- Progressive vs. Geico: Both are known for competitive rates and online convenience. Progressive offers "Name Your Price" tool, allowing you to set your budget and see what coverage you can get. Geico has a user-friendly mobile app and a wide range of discounts.

- State Farm vs. Allstate: Both are larger, more established companies with strong customer service and wide networks of agents. State Farm often offers better rates for homeowners insurance bundled with car insurance. Allstate has a "Drivewise" program that rewards safe driving habits with discounts.

- Erie Insurance: Erie is a smaller, regional insurer with a reputation for excellent customer service and competitive rates, particularly in the Mid-Atlantic and Midwest. They often offer more personalized service than larger national companies.

Remember to Compare Apples to Apples

When comparing quotes, make sure you're comparing the same coverage levels and deductibles. A lower premium might seem appealing, but it could mean you're sacrificing important coverage. Always read the fine print and understand what you're getting before you make a decision.

Tips for Lowering Your Car Insurance Rates Saving Money on Car Insurance

Okay, so you've got your quotes, and you're still not happy with the price. Don't despair! There are several things you can do to lower your rates:

- Increase Your Deductible: As mentioned earlier, a higher deductible means a lower premium. Just make sure you can afford to pay the deductible if you have to file a claim.

- Bundle Your Insurance: Many companies offer discounts if you bundle your car insurance with other policies, such as homeowners insurance or renters insurance.

- Take a Defensive Driving Course: Some insurance companies offer discounts to drivers who complete a defensive driving course.

- Maintain a Good Credit Score: As mentioned earlier, a good credit score can help you get a lower premium in many states.

- Shop Around Regularly: Don't just stick with the same insurance company year after year. Shop around every year or two to see if you can find a better deal.

- Ask About Discounts: Many insurance companies offer discounts for things like being a student, being a member of the military, or having anti-theft devices installed in your car.

- Drive Safely: This one's obvious, but it's worth repeating. Avoid accidents and tickets to keep your driving record clean.

- Consider a Usage-Based Insurance Program: Some companies offer programs that track your driving habits and reward safe drivers with discounts. These programs typically use a smartphone app or a small device plugged into your car's OBD-II port.

By following these tips, you can significantly lower your car insurance rates and save money without sacrificing coverage.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)